In a study comparing state corporate tax costs across the country, North Carolina has the lowest corporate income tax rate, at 2.5%. That's according to the latest Tax Foundation report.

The Tax Foundation, a D.C.-based think tank, produced the Location Matters report in collaboration with the audit, tax, and advisory firm KPMG LLP. The study modeled eight different types of new and mature firms and analyzed what each would pay in state and local taxes in each state.

North Carolina ranked third overall for the lowest effective state tax rates for the new firms, and fifth overall for the mature firms.

The study points out that “over the past decade, North Carolina has implemented historic tax reforms which involved, among other provisions, reductions in the state’s corporate income tax rate and paring back targeted tax incentives.”

“We see the national Location Matters study as a tool that site selectors can use to quickly screen states for their clients, because the study illustrates how state tax burdens play out in real-world scenarios,” said Christopher Chung, chief executive officer of the Economic Development Partnership of North Carolina.

“Along with a strong education ecosystem, workforce talent and solid infrastructure, a state’s tax competitiveness is an important consideration for a company deciding where to locate, remain and grow.”

Gary Salamido, president and CEO of the NC Chamber, says the study "gives North Carolina’s leaders a new resource to help us accurately benchmark our progress and identify opportunities to improve so we can continue attracting more diverse investments.”

The Study

Tax Foundation economists designed eight model firms—a corporate headquarters, a research and development facility, a technology center, a data center, a capital-intensive manufacturer, a labor-intensive manufacturer, a shared services center, and a distribution center.

KPMG calculated each firm’s tax bill twice in every state: once as a new firm eligible for tax incentives, and once as a mature firm not eligible for such incentives.

The study accounts for all business taxes including corporate income taxes, property taxes, sales taxes, unemployment insurance taxes, capital stock taxes, inventory taxes, and gross receipts taxes.

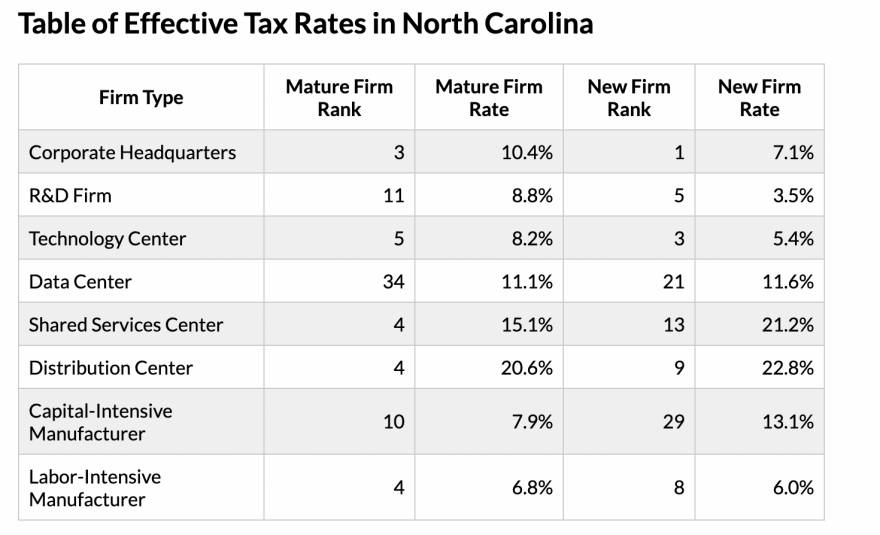

All mature model firms in North Carolina, except the mature data center, experience below-average tax rates, the study says. New firms in North Carolina generally experience below-average effective tax rates as well.

Key Findings on North Carolina

- A new corporate headquarters in North Carolina has very low income and property taxes, resulting in an effective rate of 7.1%, the lowest such rate in the country and 57% below the national median.

- North Carolina ranks third for the mature corporate headquarters with an effective rate of 10.4%.

- North Carolina’s low property taxes benefit the mature technology center, which experiences the fifth-lowest total effective rate for its firm type, as well as the mature distribution center, labor-intensive manufacturing operation, and shared services center, which all experience the fourth-lowest total effective rates for their firm types.

- The new research and development facility faces average sales and unemployment insurance tax rates in North Carolina, and property taxes are notably lower than in most states.

- Of all the firm types, data centers and new capital-intensive manufacturers experience the highest rates in North Carolina relative to other states.